Customer expectations are always changing; however, digital has not only accelerated the rate of that change but elevated those expectations. Needless to say, this has caused challenges for business, with BFSIs being particularly hard hit.

The Googles, Facebooks, and Amazons of the world have spoiled customers, providing them with seamless experiences, on-demand, wherever and however they want. And now, it’s time Financial Institutions and other BFSIs do the same, and I’ll show you how below. But before you can solve the problem, you need to understand it.

The Problem For Banking Customers

For banks, credit unions, and insurance brands, and BFSIs in general, the shift of consumer preferences towards digital solutions poses one of the biggest threats to their core modus operandi: in-person customer appointments.

And while physical bank visits were not an issue felt by banking customers previously, their perspectives have changed on two significant fronts:

Experience over products

More customers now prefer that their experience should be better, more efficient, and faster, prioritizing it over the products that they receive, which are pretty vanilla in their construct.

Convenience over privacy

Customers are also willing to let go of a little bit of privacy in exchange for more convenience, better integration of financial or banking softwares, and faster action for the services they’re choosing.

Changes in Customer Behaviour

With customers getting so used to getting all of their tasks done instantly and in a few clicks, BFSIs are lagging in adopting such efficiencies in their customer engagement models. As a result of such fundamental changes in customer expectations from the industry, we’re now witnessing alarming statistics in customer acquisition rates as experienced by banks, financial institutions, insurance companies, and BFSIs that are trying to shift their processes to a digital framework:

- 51% of customers drop off from their onboarding journey with a bank due to the length of the process.

- 46% of customers leave their applications midway because the user interface is not friendly enough to proceed.

- 41% of those who start the process digitally never return if they log out or if the sign-up process is too long and requires too much information.

In addition to changing customers’ tolerance levels towards their banks, such variables contribute largely in showing BFSIs that they have a lot of catching up to deliver the differentiated experiences that their customers have already become so used to receiving from interacting with other non-financial services.

The Industry Perspective on Digital Experiences

When we look at financial institutions and BFSIs as a whole, it’s no news that it’s a heavily regulated industry. While that in itself is not a challenge, their use of decades-old practices, processes, and financial softwares is still being followed.

Such institutions have never viewed it as a customer journey but rather a journey that happens internally within the bank and involves the customer’s file to move physically from one department to another. In simply trying to make such a process seamless and convert it into a frictionless onboarding journey for the customer expectations, many issues come to the fore.

Organizational Challenges

Before looking at how financial institutions could begin to address these bottlenecks, we need to consider some of the grave organizational challenges that exist as well:

Disconnect at the first touchpoint

Whether the customer’s first touchpoint is a website or app, in the case of a digital channel, or to visit the bank and talk to a teller for non-digital channels, this is where most of the disconnect happens.

Systems failing to cope up with expectations

On a system level, the challenge remains to cope with increasing customer expectations, be it an internal system or a legacy system with the customer.

Old and outdated processes

The fact also remains that the processes and financial softwares adopted by these institutions are simply too old to convert and involve too many layers in pushing the customer’s application from one place to another.

The true picture that this paints for financial institutions is that of struggle: breaking the numerous silos, being unable to implement automation, and using non-modular technology, rather than using modern technologies like banking softwares that offer convenience in accordance with the current needs in the digital world.

That being said, one sliver of hope we’ve seen in the last three to four years is that the right technologies have become available to remove nearly all such hurdles. With such technologies at hand, processes like identity verification and document scanning and organization can all be reduced to a matter of a few seconds and done purely digitally rather than taking days and manual interaction with people.

This is where successful institutions are now setting themselves apart, and the reason why achieving the optimal customer onboarding experience has become more critical than ever before.

How Banks Can Address the Challenges

Most banks resorted to addressing the digital shift by taking the same system and flow of process and creating an online facsimile of it.

With research showing us that 85% of customers drop off between clicking on an ad to starting their application online, it’s evident that these ways aren’t working.

We see such high drop-off rates because the customer onboarding process isn’t being adapted to digital, rather just shifted to it.

Even if financial institutions didn’t – or didn’t need to – think about these earlier, certain factors are unique to a digital journey and need to be taken into consideration:

Capturing the customer as soon as they come in

How can the institution position the journey and capture customer information so that even if the customer drops off, they can be contacted again to help move their application forward? A lot of organizations are rewarding customers to return and complete their journey, an incentive that is doing wonders in the way of new customer acquisitions.

Upgrading to new systems

Most core banking softwares are quite archaic and need upgrading, and to run a digital workflow, institutions will need new systems rather than relying on the same old financial softwares.

Speeding up the process

With digital experiences, the pace of action is one of the most critical factors, and the question becomes of how fast banks can get the customer in and through the system and convert them into revenue-generating customers.

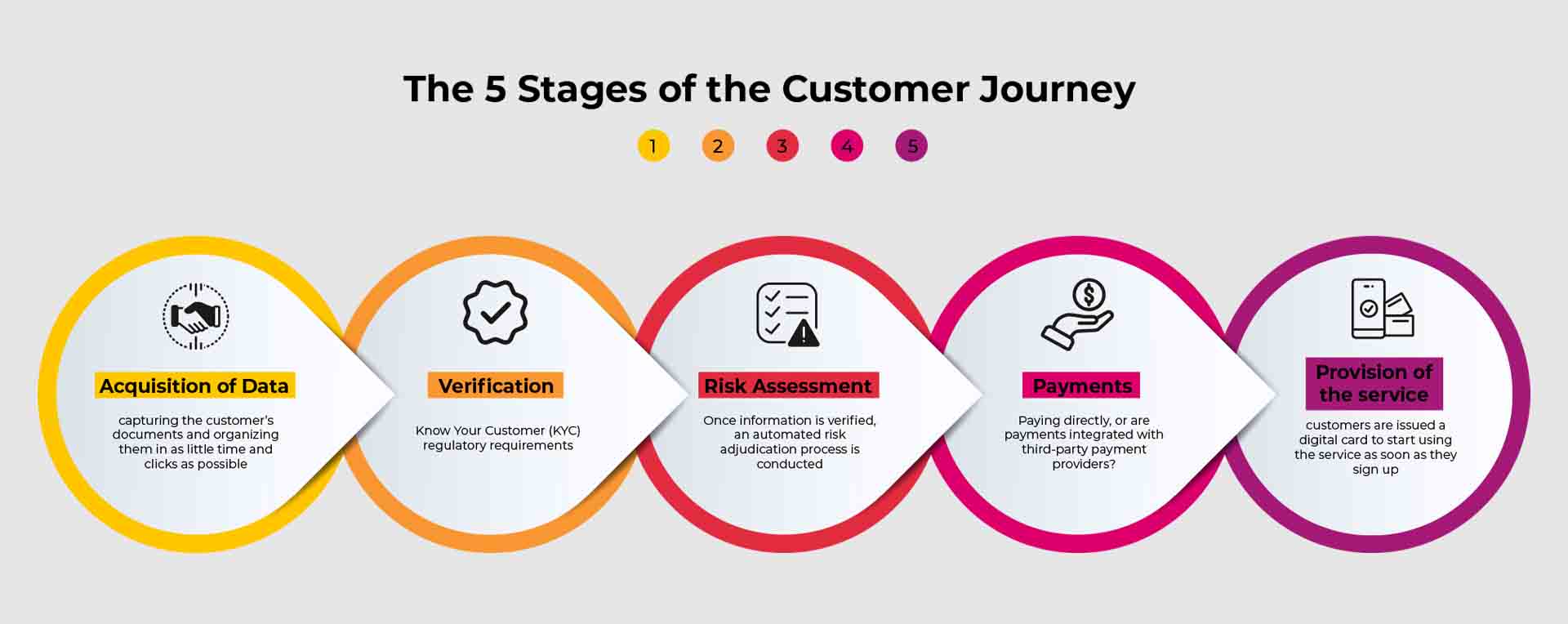

The 5 Stages of the Customer Journey

Understanding that the customer journey cannot remain in the background anymore needs to be prioritized above all else. From an organizational point of view, it can be broken down into five stages:

Acquisition of Data

Whether customers fill-up the form themselves or their information comes from third-party portals, capturing their documents and organizing them in as little time and clicks as possible is the first stage.

Verification

Is the customer who they say they are? Depending on the product offered, there are different Know Your Customer (KYC) regulatory requirements.

Risk Assessment

Once customer information is verified, an automated risk adjudication process is conducted.

Payments

Are customers paying directly, or are payments integrated with third-party payment providers?

Provision of the Service

The customers are issued a digital card to add to their Apple or Google wallets to get started with using the service as soon as they sign up.

Interestingly, from the first to the last stage, this entire journey can be 100% automated, without human intervention, and in most cases done almost instantaneously.

The experience needs to be easy, fast, and frictionless. In 5-minutes, a customer can and should be able to activate their account, with a digital card added to their device, all without ever having to set foot into a branch.

Takeaway

Every organization hoping to enter the digital era needs to break from or evolve their traditional processes, and this, although harder, is especially important for financial institutions. The question is, how to create a solution that balances customer expectations and business objections; and it will be those who can most effectively achieve that, who will be the most successful in the future.