Unless you have been hiding under a rock, the odds are that you have heard about the fascinating world of Artificial Intelligence and the transformational impact it is going to have on our lives. Certain parts of the euphoria remind us of the dot-com bubble from the ‘90s – when the technology hype hit its peak. There seems to be intense excitement at all levels, from CEOs and analysts to grassroots developers; all are expecting Artificial Intelligence, or AI technology, to not only dramatically change our lives but the world. Well, we really can’t blame them, given all the excitement created by the billions of dollars being invested in the Artificial Intelligence domain. With all the stars perfectly aligned, perhaps it is best to “peel the onion” a little bit in hopes of gaining a better understanding of what AI really is, why now and why all the hype, and how AI technology and AI companies can dramatically change the Telecom Industry landscape, in particular.

What is Artificial Intelligence and why the hype now?

AI is essentially humans teaching machines how to learn and mimic their intellect.

Quite like a toddler- who learns by experience, constantly absorbing information, decoding it and understanding patterns – we feed machines huge amounts of data that create their own algorithms and constantly tweak them to meet their objectives. Over time the program gets smarter and very human-like, i.e., less artificial and more intelligent.

During the past few years, some factors have led to AI technology coming closer to unleashing its true potential – mainly, a ton of data becoming available along with faster GPUs for processing it.

With billions of things getting connected to the web, there is a tsunami of information being generated. Since the dawn of time until 2004, around 5 exabytes of information have been created and captured. To put that visually, try and imagine a stack of books that spans from earth all the way to Pluto and back 80 times over. Impressive, certainly, but over the last decade, the amount of data being captured has exploded with 90 percent of the world’s collective data reportedly being generated in the past two years alone. And now thanks to advances in processing speeds, computers can make sense of all this information faster and more efficiently.

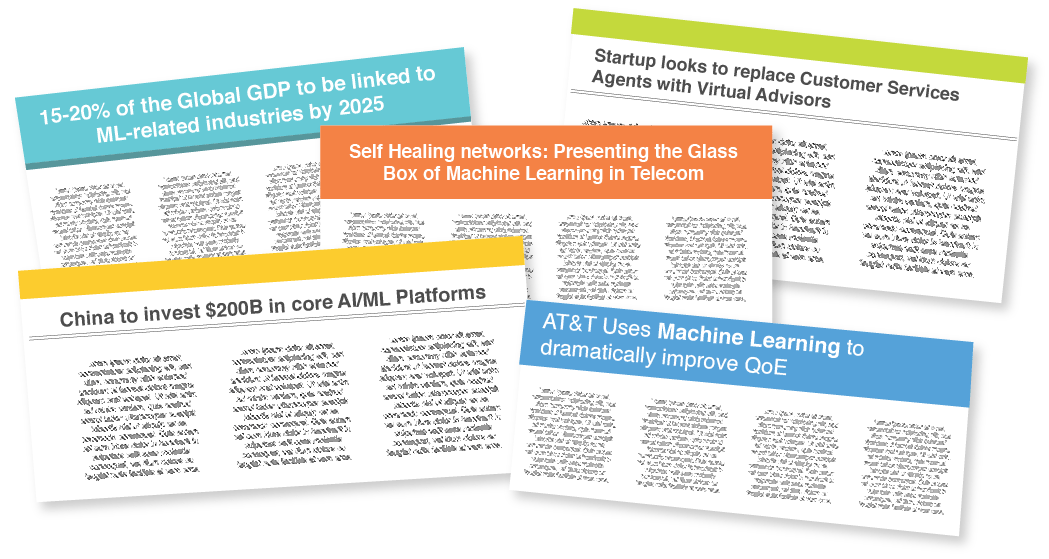

Because of this, tech giants and VCs are pumping the market with cash and new applications and investing into AI companies. China alone has already invested $109BN in this space, and the race between countries is heating up. The reason being that 15-20 percent of the global GDP is forecasted to be linked to AI-related industries by 2025! Mind numbing, isn’t it?

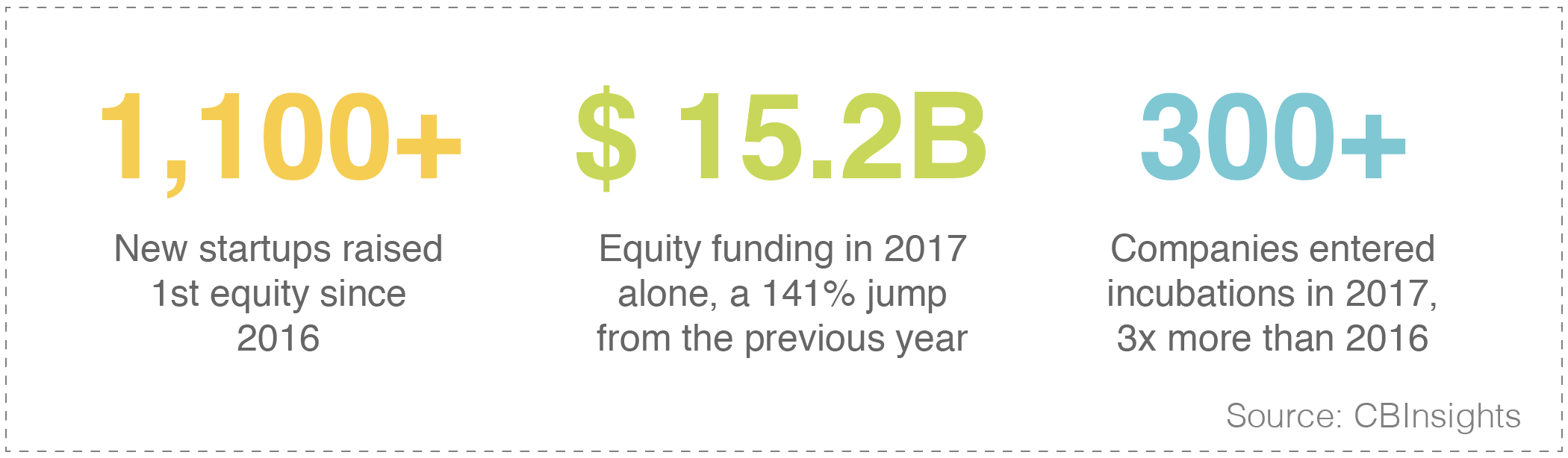

1100+ New startups raised 1st equity since 2016, $15.2B Equity funding in 2017 alone, a 141% jump from the previous year, 300+ Companies entered incubations in 2017, 3x more than 2016. Source: CBInsights

How is Artificial Intelligence different from Predictive Analytics and Big Data? Are there financial benefits of investing in all three?

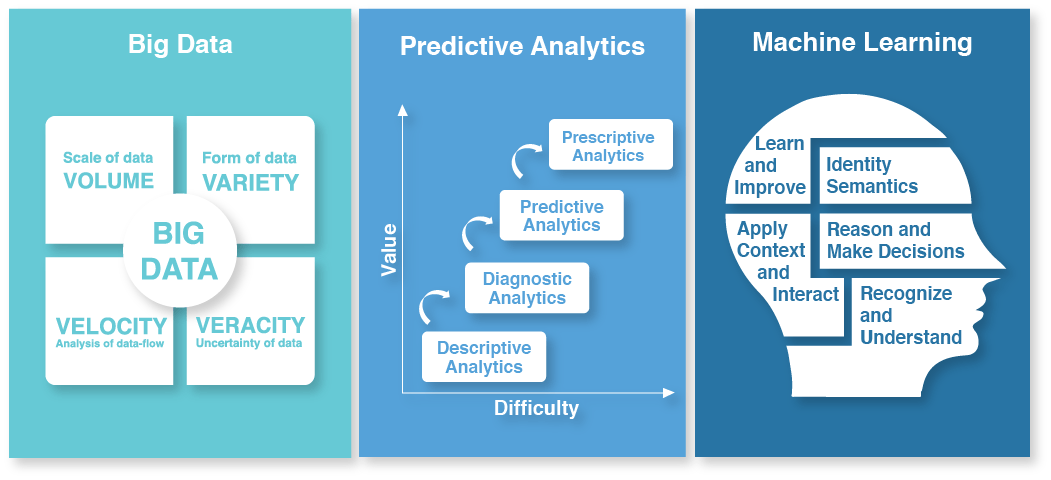

Often, people inquire what is the difference between Big Data, Predictive Analytics, and Machine Learning. They want to have the ability to differentiate between the three to ensure adequate allocation of resources and to set right expectations with all the stakeholders..

Big Data: Collection of “data sets” which are large, complex, and difficult to process using on-hand database management tools.

Predictive Analytics: Practice of extracting information from existing data sets in order to determine patterns and accurately predict future outcomes, trends, and behaviour.

Machine Learning: Machines performing tasks that normally require human intelligence (visual perception, decision-making, learning, etc.). This takes into account the entire context of the situation.

In a nutshell, creating Big Data lakes for gleaning insights and learning is the foundation in which all corporations must invest. Using Machine Learning, the self-learning engine to unlock value from the data, organizations can then extract insights, predict outcomes, and perform human-like tasks. Investment in all three, i.e., Big Data, Predictive Analytics, and Machine Learning is quickly being elevated to table stakes. Business and IT teams need to work “hand in glove” to prioritize the required output. On the inverse, we have found that working in isolation leads to converting the proverbial haystack into a bunch of needles rather than finding the one insight which is critical to business.

Should we bet on AI and Robotic Process Automation (RPA)? Everyone seems to be deploying them, should we invest in them now?

These, my dear Watson, are the wrong questions to be asking! The metaphorical cart is coming before the horse, if you would. The correct question should be, “How do I use technology to solve my business problem quickly and efficiently?”

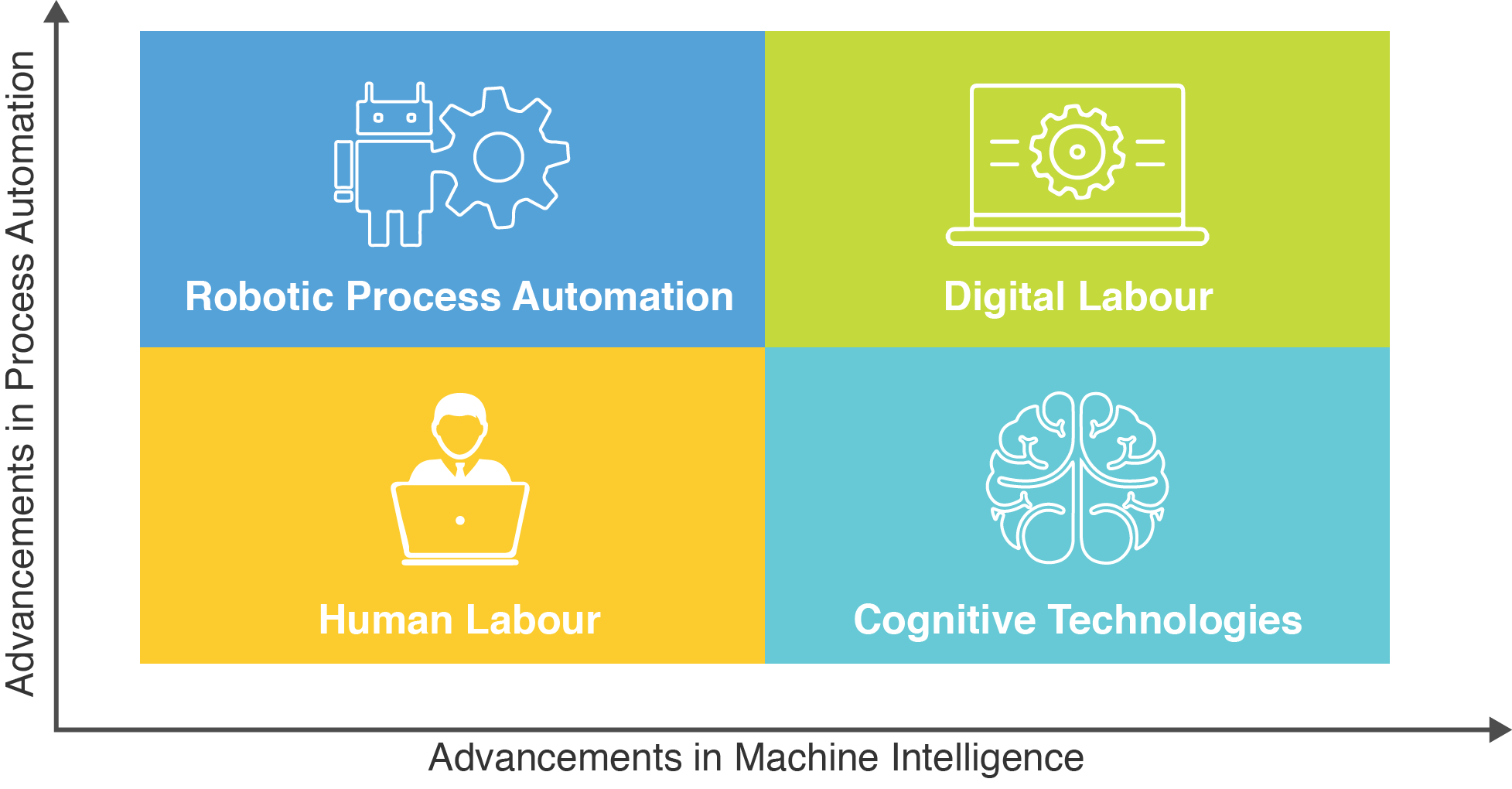

First, however, let’s dive into both RPA and AI to distinguish the two. The goal is to bridge the journey from Human to Digital labour in the most efficient way. Given the pressures on the bottom line, “Digital Labour” is no longer a consideration, rather, a mandate for most companies across the world. RPA and AI are the two unique sets of tools used to traverse the journey from one end of the spectrum to the other, i.e., Digital Labour = Cognitive Computing (AI) + RPA (Digital work).

Basic RPA consists of automating entry-level transactional, rule-based and repeatable processes. It involves working with structured data and within well-defined parameters in order for the bots to complete the tasks autonomously. However, digital labour is automation driven by self-learning and adaptive technologies. It involves self-learning, digestion of super data sets, hypothesis generation, and evidence-based learning. All fun stuff!

Most companies and businesses we speak to love the concept of AI and want to jump right into it. However, it is a journey of realization, meaning you need to ask yourself some questions first. What really are the use cases? Can you articulate the pain points? Can you clearly quantify benefits to help determine whether AI and/or automation is necessary? It is then that collectively decided on which is the best course of action and implementation.

What are the telecom specific use cases of AI technology? What are the financial benefits?

The telecom industry is at a crossroads. No other industry is driven as much by bits and bytes while at the same time faces disintermediating challenges for the same reasons. Business models are changing, customer expectations and behaviour are constantly evolving, legacy economics and paradigms are becoming untenable. This is why 2014 was the first year when the total global revenue of telcos had marginally negative growth. From then on, every investor relations call is bombarded with questions on increasing revenue, reducing OPEX and CAPEX, and here is where AI technology opens up an opportunity for AI companies.

Capital Reduction ($10-12 BN savings over a decade)

Between the three telcos in Canada, the collective annual capital spend is ~$10BN to grow and sustain their respective networks. Using this run rate would peg the capital spending over the next decade to be at ~$100BN, even when not taking into consideration a spike of an estimated 40 percent due to an increased spend on 5G and fibre deployments.

Given that the lifecycle of technologies has reduced considerably – CDMA lasted 25 years, HSPA possibly 10, and LTE even less. It’s time to recuperate that investment cycle is reducing. In the meanwhile, cost of electronics has gone down, and most of the capital effort is spent on the optimization of networks and installation.

At last count, 70 percent of capital cost to upgrade from one technology to another was spent on labour and infrastructure, and only 30 percent on the actual OEM related electronics. That would technically peg the telcos as infrastructure players, vis-à-vis, a pure play telco. However, AI and other combinatorial techs can be leveraged to reduce that labour cost for optimization significantly. A lot of the OEMs have started providing their own software for SON (Self Optimizing Networks), but that would really be akin to asking the wolves guard the sheep. Telcos need to have their POV and build on it over time, to ensure basic hygiene and best practices are kept in-house. Also, predicting usage of subscribers by geography and ensuring the network is dimensioned correctly will not be done on the side of the desk of engineers, rather, through deep scenario analysis and planning, considering all parameters. Lastly, optimization of spectrum auction pricing can be done using game theory and decision trees. Given the appetite of operators to spend billions on it, we expect a healthy dose of AI to be used to save thousands of consultant hours and save millions (if not billions) of dollars in the process.

We estimate at least 10-15 percent ($10BN) of the capital envelope can be reduced using cognitive technologies holistically across the process.

OPEX Reduction ($3-5BN savings over a decade)

Predictive Maintenance: The ability to fix problems with telecom hardware (such as cell towers, power lines, etc) before they happen and by detecting signals that usually lead to failure. This significantly reduces downtime and dramatically improves Customer Experience and churn metrics.

Video Analysis: Instead of sending field workers to check on-site hardware periodically, AT&T has invested heavily in drones and in AI to analyze video data captured, which proactively raises flags for the field team to go in and fix issues.

Self-Driving Networks: In the future it’s likely that governments might ban humans from driving cars as it is a reckless or unnecessarily risky activity. Similarly, there is no reason why we shouldn’t be done away with the Network Engineers! A perfect world really would be where networks would run themselves; away from our grubby, inefficient hands. This provides an opportunity for cost-cutting and efficiency gains. Ideally, we should not need so much staff to manage operator telecom networks. A lightly staffed network powered by an economical but sophisticated AI will look more desirable than ever. That is truly aspirational today, but something to work towards.

Customer Service ChatBots: Every telecom customer calls in four times a year at an average cost of $15/call for password resets, billing inquiries, or changing plan details. This OPEX of ~$2BN/year across the three operators can be dramatically slashed by using chatbots which are equipped to do the same. Automating 10-15 percent of the customer service inquiries, routing customers to the proper agent, and routing prospects with buying intent directly to salespeople will make a material impact on the bottom line! Further, leveraging NLP, sentiment analysis and text to speech virtual customer service agents could be used to replace humans, with the customer not being able to distinguish one from the other. That could be a tangible reality in 5-10 years’ time; taking the cost down from $15 to 15 cents per call.

Speech and Voice Services for Customers: Allowing telecom customers to browse, explore, and buy content by spoken word rather than remote control (e.g., DISH network and Amazon’s Alexa partnership).

Security and Fraud: Detect fraudulent activity in credit-card transactions or identifying web traffic to the website and customers, looking to exploit network and infrastructure vulnerabilities.

Revenue Enhancement

I algorithms can help combine historic patterns, psychographic analysis and behaviour (plus “look-alike” patterns) with ongoing real-time engagement to provide relevant, targeted, contextual experiences for consumers. The outcome will be upselling recommendations and offers, helping improve the conversion rate of offers, and enabling incremental wallet share. The same algorithms could be potentially leveraged to predict subscribers willingness to pay a particular price for a product, estimate product price elasticities, and quantify sales leads likelihood to close.

How do we tackle AI as an organization? How much investment is required?

It is best to use a good framework to get the ball rolling organization-wide. Some frameworks that we have used in the past include:

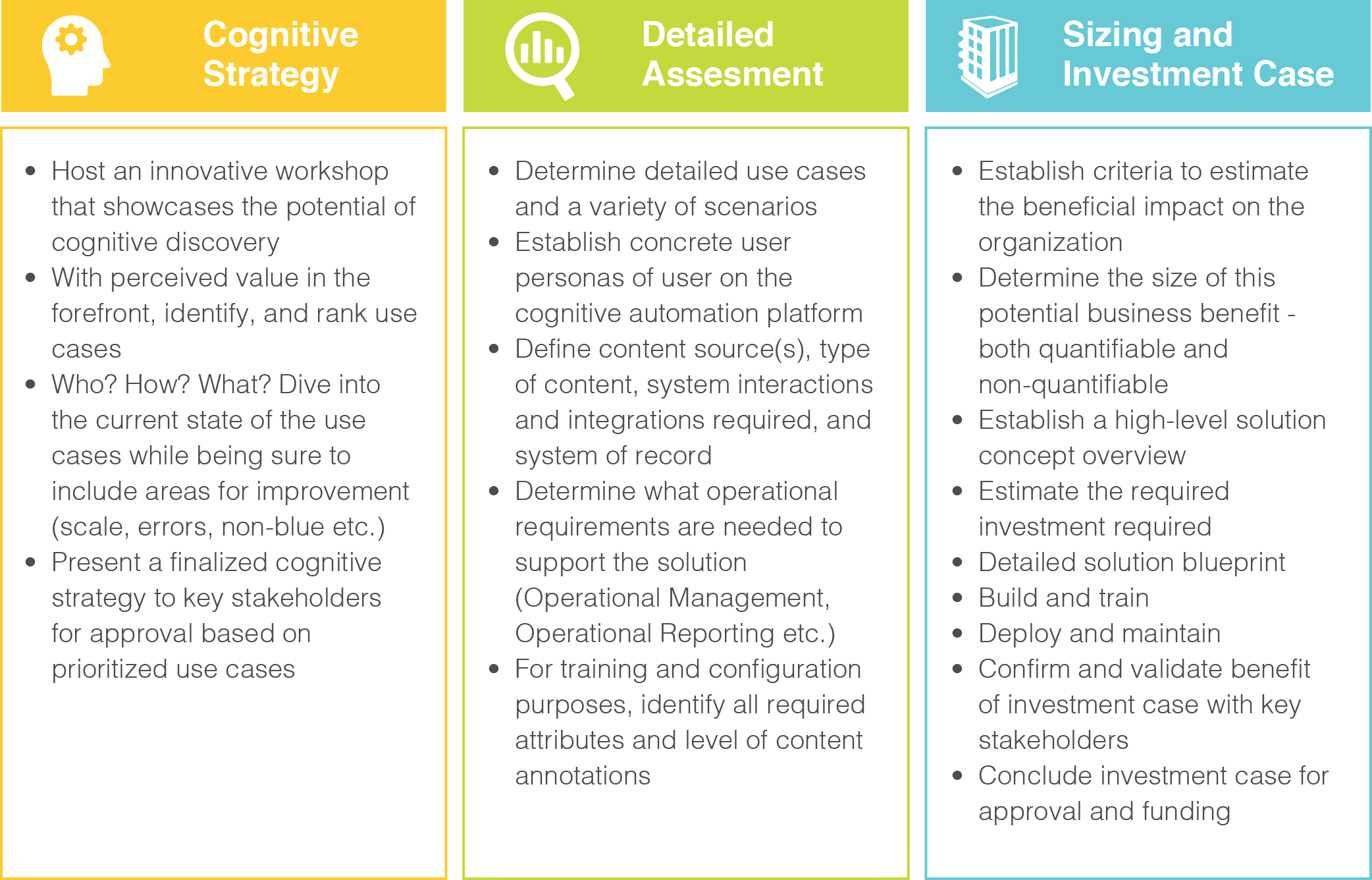

Cognitive Strategy

Host an innovative workshop that showcases the potential of cognitive discovery, With perceived value in the forefront, identify, and rank use cases, Who? How? What? Dive into the current state of the use cases while being sure to include areas for improvement (scale, errors, non-blue etc.), Present a finalized cognitive strategy to key stakeholders for approval based on prioritised use cases.

Detailed Assesment

Determine detailed use cases and a variety of scenarios, Establish concrete user personas of user on the cognitive automation platform, Define content source(s), type of content, system interactions and integrations required, and system of record, Determine what operational requirements are needed to support the solution (Operational Management, Operational Reporting etc.), For training and configuration purposes, identify all required attributes and level of content annotations

Sizing and Investment Case

Establish criteria to estimate the beneficial impact on the organization, Determine the size of this potential business benefit – both quantifiable and non-quantifiable, Establish a high-level solution concept overview, Estimate the required investment required, Detailed solution blueprint, Build and train, Deploy and maintain, Confirm and validate benefit of investment case with key stakeholders, Conclude investment case for approval and funding

We understand that AI can be intimidating and complicated, which is why we encourage you to engage us for a better understanding of the foundational capabilities, needed to get an AI program up and running. From building use cases, decision-making paradigms, economic impact analysis, choosing governance model and platforms to be deployed, we have gone through the process a few times. Every business is unique; we look forward to learning more about your specific needs to determine how we can accelerate your digital transformation.