Your digital identity is arguably more valuable than cash and is used by online operators for ordering products and completing the transaction in a buy flow system. While convenient, on the flip side, the online availability of personal information isn’t without risks. Hacks, breaches, and even full-blown identity thefts are still quite common, and it’s even more imperative to mitigate such risks during an era of digital transformation.

The concept of Digital Identity Verification is a byproduct of the internet, digital transformation, and, in its simplest terms, is when companies verify the identity of the online customers and clients they do business with. This can be done through digital identity verification software tools available in the market, such as Onfido, Jumio, IDology, and Acuant that can authenticate scanned copies of documents like passports, driver’s licenses, and other nationally issued ID from authoritative sources or proprietary government data.

Today, I hope to give you all, especially companies undergoing digital transformation, a buy flow centric crash course on Digital Identity Verification, including what it is, what it looks like, why you need it, and some of the challenges and benefits associated with verifying your digital identity.

Enjoy!

What makes up a Digital Identity?

All the information about someone’s digital identity can be categorized into two groups with a few examples provided:

A person’s digital attributes:

- Birth date

- Email addresses

- Bank details

- Biometrics (fingerprints, eye scan, 3D face map)

A person’s digital activities:

- Search queries

- Purchase history

- Comments, likes, and shares on social media

- Forum posts

The Digital Identity Verification journey

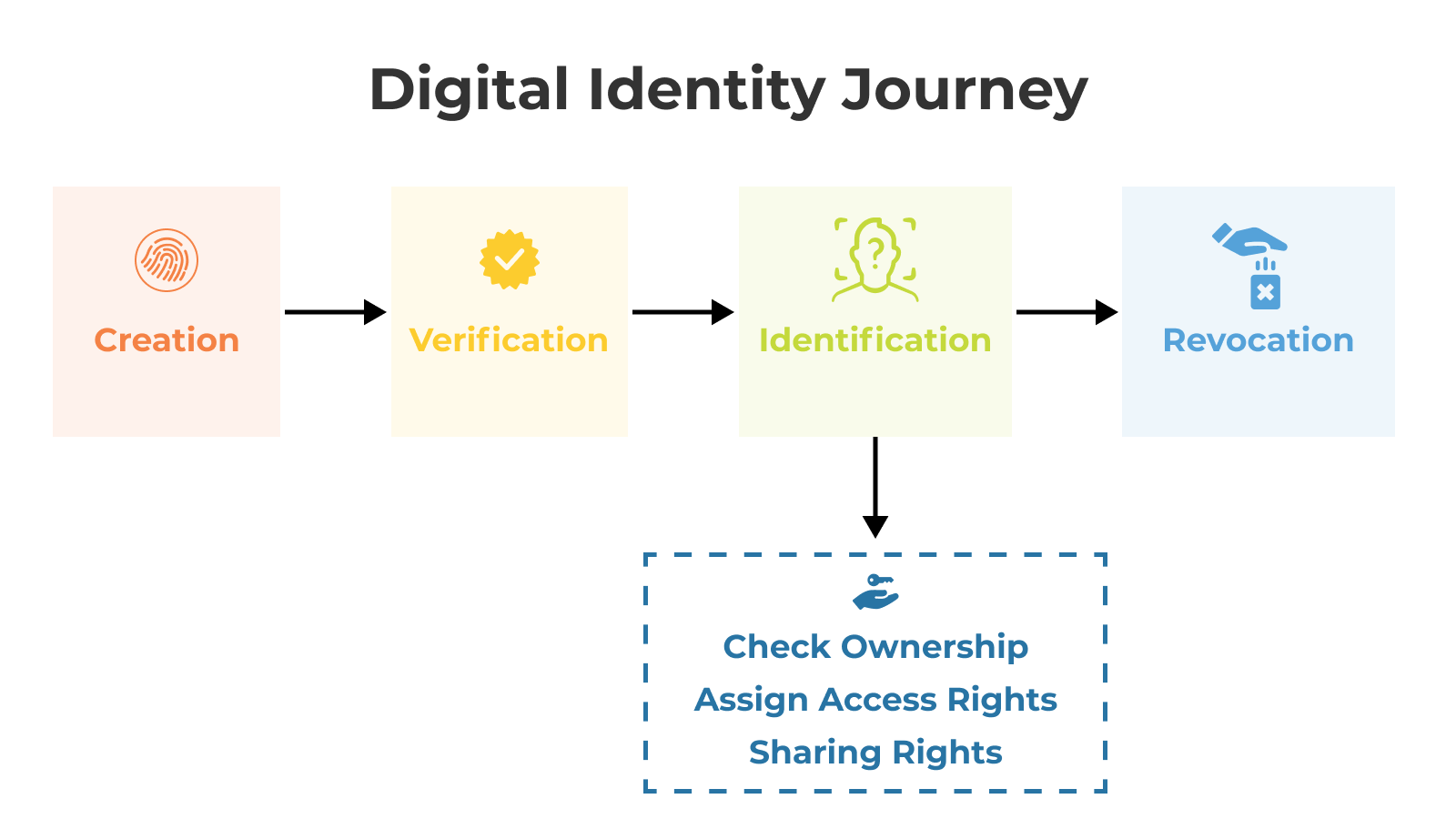

The Digital Identity Verification journey starts with the creation of a user’s identity and its distribution over the network, preceding the following steps:

- The verification of identity to ensure all identity traits are correct.

- The use of identity with:

- The authentication to check a person’s ownership of some assets.

- The authorization of role/access rights based on identity.

- The authentication attributes get shared with multiple parties.

The last step in this journey is to revoke identity from the system when digital identity information needs to be removed/ deleted.

Why is Digital Identity Verification necessary?

Almost all businesses are going through digital transformation in one way or another and moving to digital, e.g. banks, retail, telco, and more. Companies are now using digital infrastructure to carry out their online operations to get people connected with what they want. Still, many companies are continuing to physically use identity checks, such as when one needs an in-person verification to open a bank account, get a new phone number, or notarize a document. In today’s rapidly growing online era, this is not a scalable solution; slowing and limiting digitization. Digital Identity Verification can speed up all these processes and helps remove issues such as remote location access and geographical boundaries.

Digital Identity Verification for Buy Flow

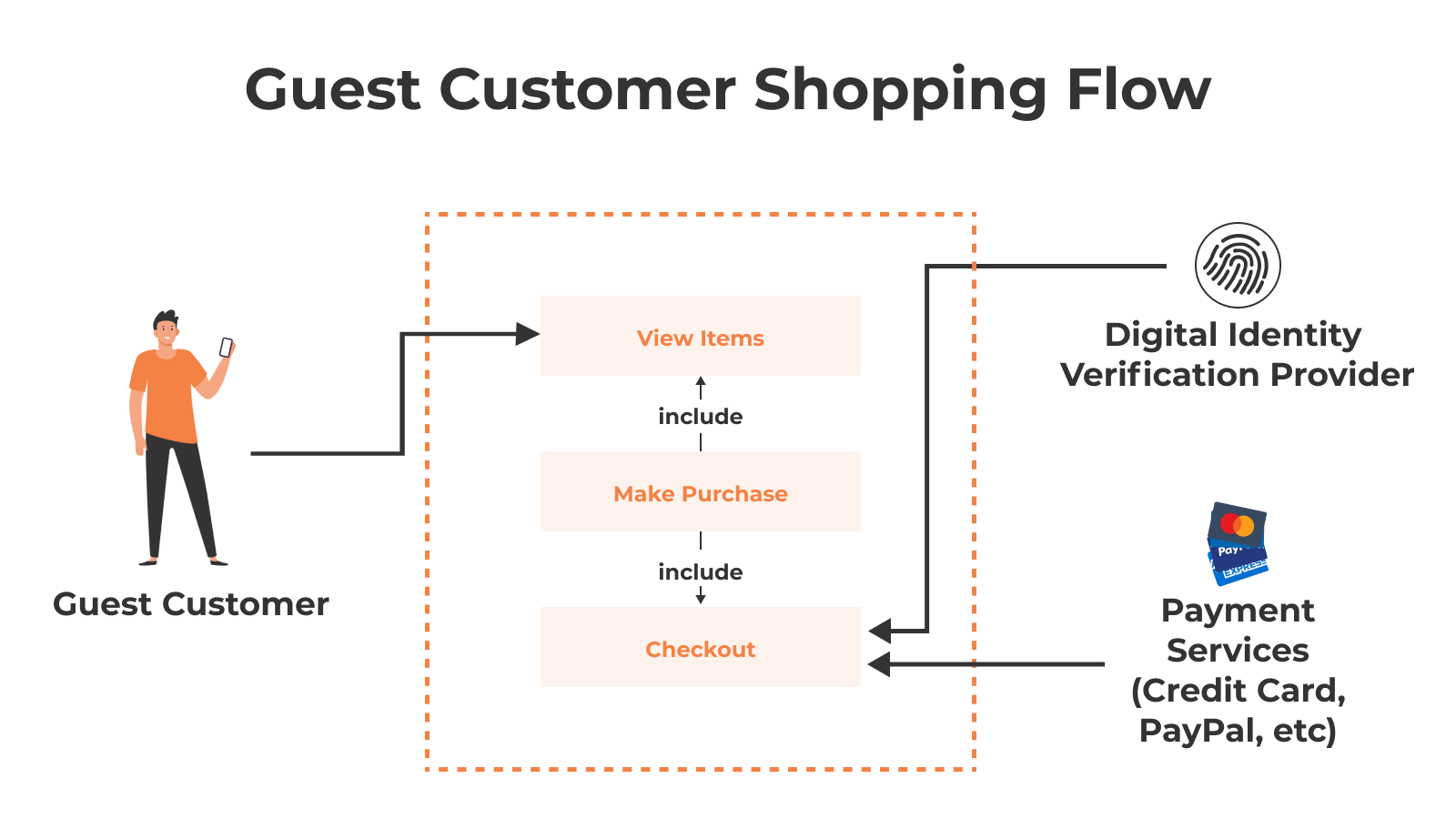

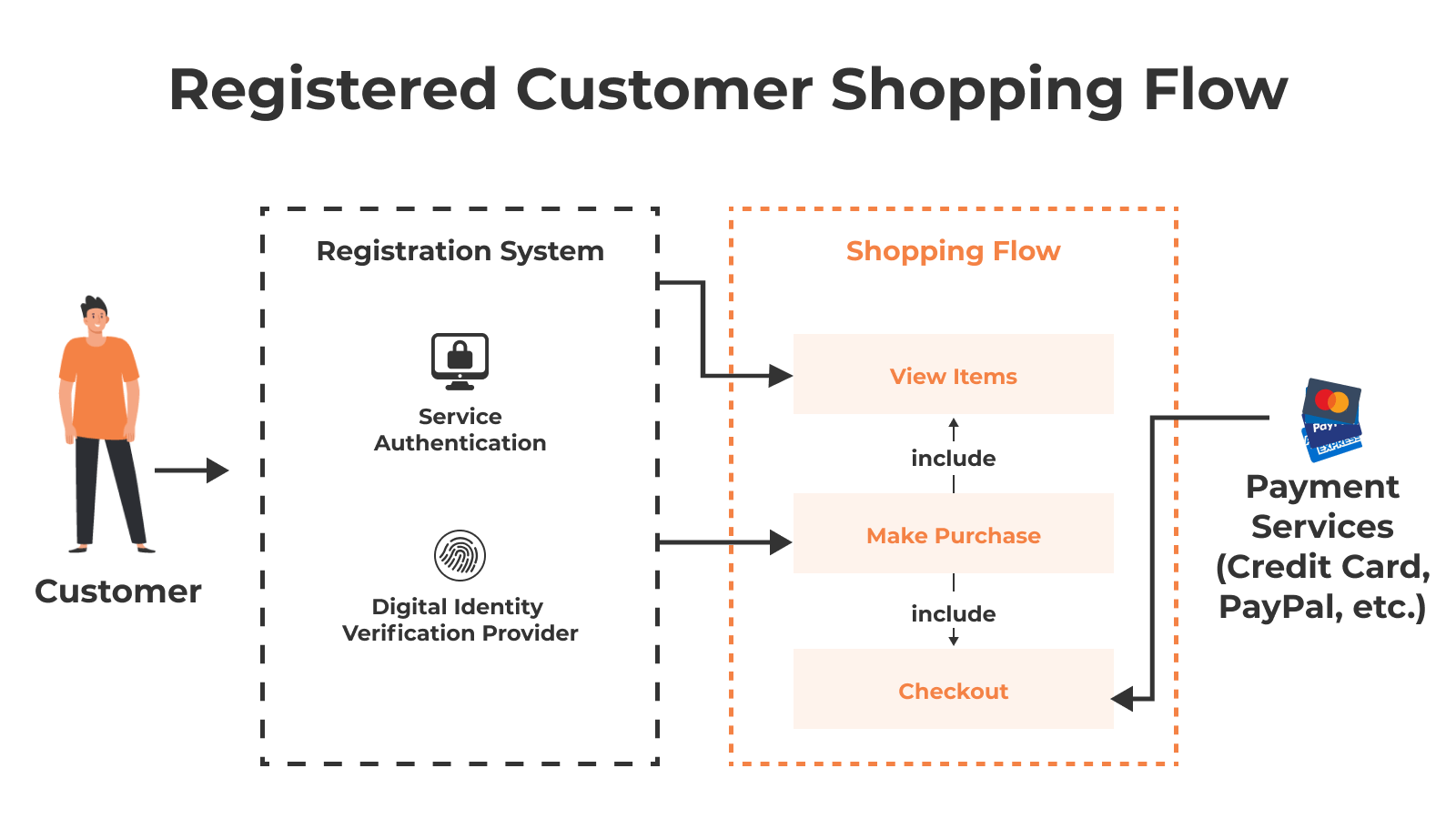

Buy Flow or Shopping Flow refers to online shopping, where users must complete some steps to buy their desired products directly from a website.

Digital verification systems are a must-have technology in the buy flow process as most eCommerce businesses are moving towards digitalization.

However, like with anything worth doing, there are some challenges associated with relying on digital identification, but by the end of this piece, I think you’ll agree, they are dwarfed by the benefits it brings.

Challenges of Digital Identity Verification in Buy Flow

Data availability and management Issues: Tracing a customer’s identity is an integral part of the digital verification process. It requires data to be cross-checked and matched for accuracy, including the collection of personally identifiable information (PII). The data is necessary, but can often leave customers feeling uneasy. Giving out your necessary credentials and personal data on something like a credit history can open up security risks, exposing personal data to a genuine threat of digital malice.

For not only service standards but adequate security to be achieved, companies need to adopt security solutions for storing customer’s data online. All the personal data and documents should be cross-checked with the official databases provided by applicable authorities. In the absence of such sources, it will be challenging to perform verification checks for authentication or, for that matter, to refuse access. Ensuring the best possible security and handling risk management will require identity expertise in multiple data collection methods for online ID verification. It’s paramount that users have control over the data collection methods and should know how their personal identity traits will be used for online validations.

Obstacles in determining the accuracy of Digital Identity Verification: To create, maintain, and grow your customer base, it’s crucial to have accurate, efficient, and customer-friendly verification in place. This helps to ensure your brand comes off as a trusted service provider. To achieve this, you need a dynamic identity verification system that can handle large audiences while performing verification repeatedly. Applying Know Your Customer (KYC) processes to prevent frauds are also very important in this regard. To handle all these things, you also need tangible resource investments at the back-end to maintain secure platforms.

Enhancing digital trust and customer experience: Your customers have been exposed to and likely already have several online identity verification systems that they use. However, having complex and suspicious data collection methods, risky transactions, and unfriendly user interfaces can put off new and existing customers alike very quickly. Establishing trust is vital for achieving long term success in the digital world. You must always be providing the right solutions for the right users and should be willing to extend a helping hand if required quickly. To achieve success, your selection of online identity verification tools must provide usability in the following aspects:

- Providing users with ownership and data security

- Perform regular verifications for the consistency

- Safeguard the clients against potential cybersecurity threats

- Risk and compliance management for business growth

Catering to data protection and privacy regulations: With an increase in the usage of identity verification applications, there are also continuous changes in regulatory requirements associated with them. Customers are more concerned about how their personal data is collected, screened, and stored. This means that firms providing the Digital Identity Verifications need to keep up to date with changing regulations and policies. International standards and regulations are being formed to stay on of advancements and technological changes. As such, security standards must be updated and compliant with the latest data protection policies rolled out by the regulatory authorities.

Benefits of Digital Identity Verification in Buy Flow

Protects your business against criminal activity: Hacking and identity fraud are commonplace in the digital world, which is why businesses need to protect their customers and themselves. One of the key advantages of Digital Identity Verification is that it helps keep your online business safe against such malice by identifying your users’ personal digital traits to ensure that their transactions are legitimate. Identity verification provides a better user experience with a sense of safety against all online threats, which will eventually result in better customer experience and loyalty.

Helps businesses comply with AML and KYC rules: Online businesses need to be AML (Anti-Money Laundering) and KYC (Know Your Customer) compliant to prevent the flow of dirty money within their systems, not to mention avoiding the risk of a hefty fine and damaging their reputation. A practical and straightforward way for businesses to prevent this from happening is to have a sound, reliable system in place to verify their customers’ digital identities.

Improves customer experience and signup rates: Digital Identity Verification helps to improve the overall user experience, leading to an increase in signup rates. Digital identity verification is a real-time process, so it makes the processes quicker and smooth for customers. If you have a sound digital identity verification system in place, it can verify users within seconds. That means customers are no longer required to submit the hard copies of passports or driver’s licence for a signup process, which takes days if not weeks in some cases. Instead, customers can get their identity verified right there and then.

Reduces operational costs: A significant advantage of using Digital Identity Verification is that it saves operational costs for the business. This goes on to further protect not only the business but the customer as well.

Take Away

Much like I promised at the beginning, by now, you should have a reasonably solid understanding of not only Digital Identity Verification, but what it is, why you need it, and some of the challenges you can expect on your way to the benefits it surely brings. However, as the world is shifting undeniably towards digital, the sooner enterprises start to make this transition, the better off not only they will be, but their customers. Because, as should be clear, Digital Identity Verification does much more than provide good customer experience, it gives a sense of security for both the company and its customers – and that’s just good business.