Decade-old legacy systems still underpin much of banking operations for many financial institutions, despite efforts to modernize. Building new technology around it while still supporting legacy systems and ensuring security is highly complex.

Testing different end-points and applications involved in a single transaction, such as opening an account, is challenging. To keep up with trends and customer expectations, banks have no choice but to innovate, test, and deliver new products constantly.

Challenges

- Human intensive effort in managing resources, budget, and on-time delivery while performing manual testing

- Longer testing cycles because of manual testing; it takes more time and resources to perform regression and identify defects

- Multi-platform with legacy desktop application to applications running on tablets

Solution

mobileLIVE deployed robotic test automation through UXPLORE, to help test dozens of account opening flows, each with numerous variations on multiple platforms.

By simulating the actions performed by a teller on a legacy application to emulate signature flow on an iPad and verifying the signed document against a golden reference – we were able to ensure a seamless transaction and user experience.

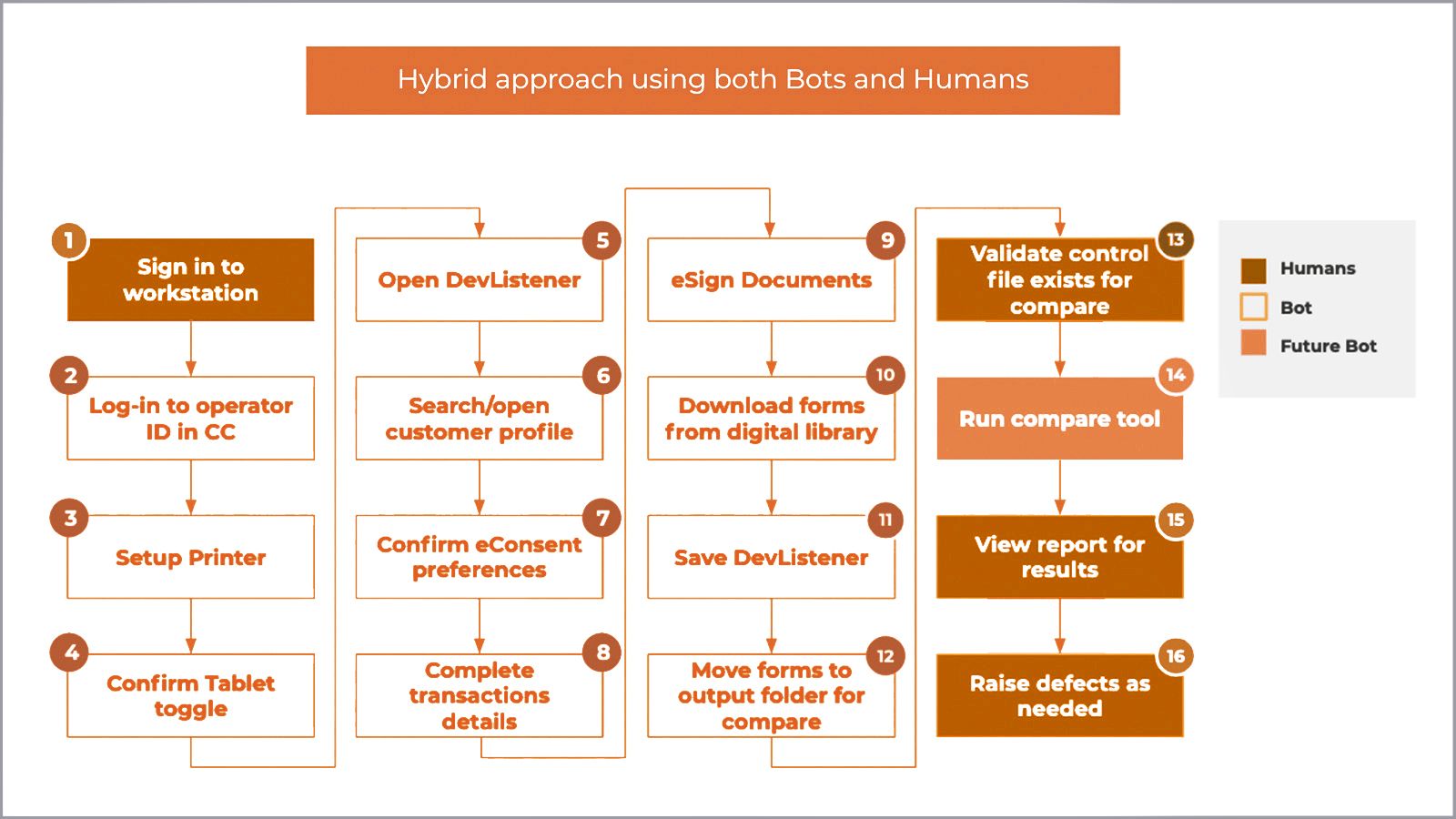

We delivered the solution with a hybrid approach using both Bots and Humans to perform these complex automation tasks in the UAT environment.

Impact/Success

- 60% Reusability of test cases across the organization

- 50% Reduction in testing effort and time

- 5x Fewer Defects by preventing defect before going into production

- 3x Faster regression cycles on nightly builds

- Continuous Testing afterhours, reducing the workload of UAT testers

- Increased Scalability for easy plug and play of test-cases for additional devices and functionality

Using UXPLORE to automate and perform several tests across multiple platforms for simulating account opening, e-Signing on iPad, and downloading e-Forms, we delivered end-to-end automation, continuous delivery, and testing with a single orchestration tool.